[mc4wp_form id=”2320″]

A simplified guide to two-factor authentication

-

March 10, 2025

- Posted by: Evans Asare

2FA: A simplified guide to two-factor authentication. It’s no secret that cybercriminals are hungry for passwords and other user data.

An unprotected password can help cybercriminals access your bank account, credit cards, or personal websites. From there, they can:

- Sell your personal information.

- Access your money.

- Compromise your overall digital security.

But the battle isn’t lost. One way to quickly boost the safety of your online accounts is to enable two-factor authentication. From safeguarding mobile banking details to shielding your medical history, 2FA verification should be a pillar of your internet safety practices.

What is 2FA?

2FA, or two factor authentication, is when a site or app requires you to enter an extra form of identification to verify your identity and log into your account. 2FA requires people to verify their identity based on two of the three factors that can confirm identity:

- Something you know (e.g., a password)

- Something you have (e.g., a phone)

- Something you are (e.g., a fingerprint or facial scan)

That extra ID can be a code generated and sent directly through a text message or authenticator app. It can also be in the form of a piece of hardware like a USB drive or a biometric ID like a fingerprint.

Let’s break this down even further, including how two-factor authentication works, types of two-factor authentication, and why two-factor authentication is so important.

2FA vs. multi-factor authentication (MFA)

MFA refers to any type of authentication that requires two or more factors. That means that while 2FA is a form of MFA, not all forms of MFA have only two factors. Increasing the level of security by adding an extra factor makes it much more difficult for hackers to gain entry into a system.

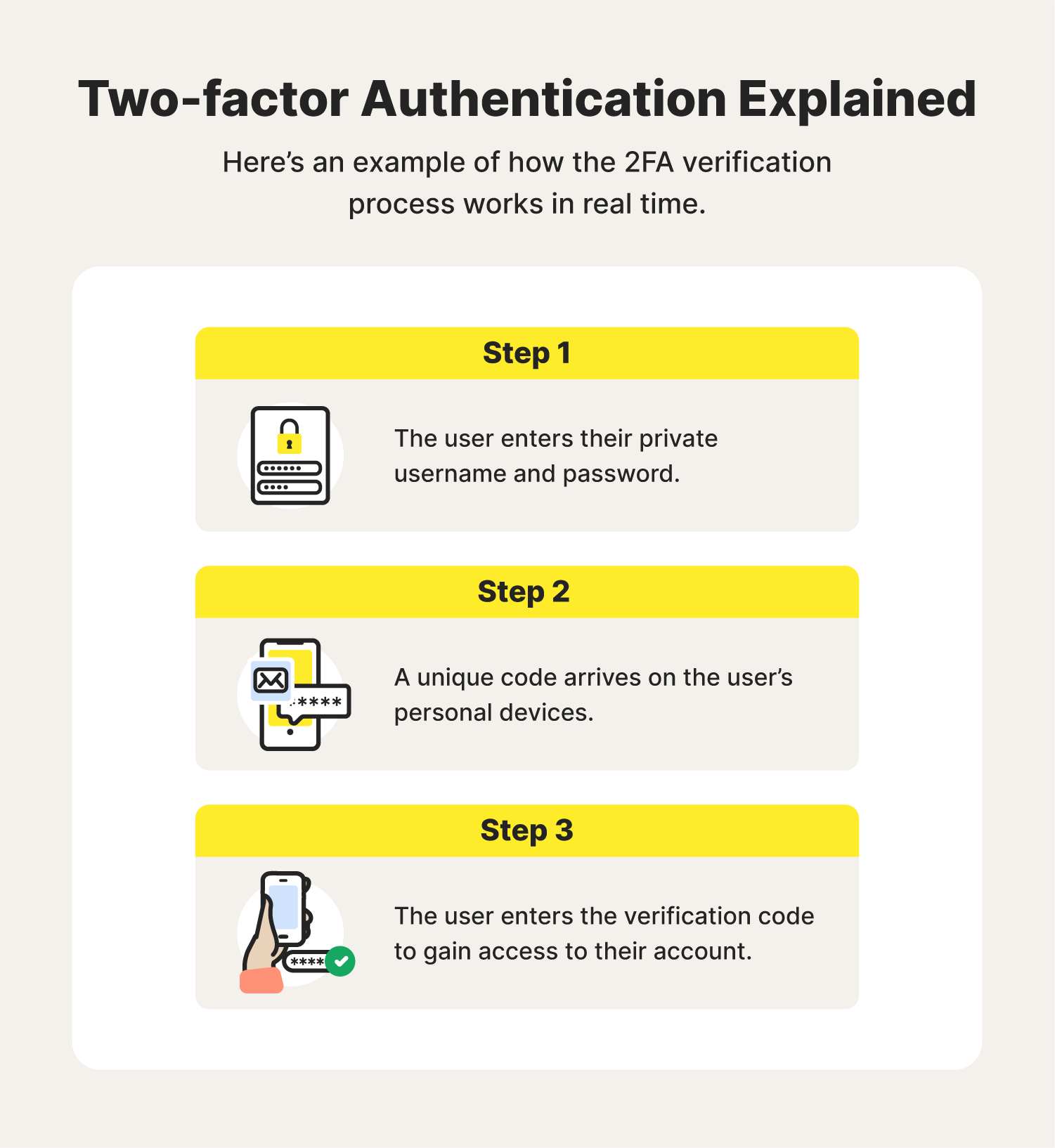

How does 2FA work?

As the name suggests, two-factor authentication requires one extra step—a second factor—to log into an account. The process works as follows:

- The user enters their username and password.

- The account, platform, or site prompts users to input another verification form, such as a one-time password or code sent to their mobile phone.

- The user enters the verification code to access their account.

An ATM card is a good example of two-factor authentication in the real world. In addition to physically presenting the card (something you have), you must also type in your PIN (something you know) to verify your identity and access your account.

Why is two-factor authentication important?

Two-factor authentication is important because adding an extra layer of verification before you can access your account means thieves will struggle to get your personal information. As cybercriminals continue to use brute force or password spraying attacks, even if you’re following good password security practices you need 2FA as well. It might seem like a hassle to add an extra step to your web surfing. But without it, you could be leaving yourself vulnerable to:

- Cybercriminals who want to steal your personal information

- Hackers trying to access your bank accounts

- Thieves breaking into your online credit card portals

If you add a knowledge factor to your bank account, a cybercriminal who knows your password due to a data breach or phishing operation won’t be able to access the account. This is because your phone will receive the verification code.

That way, those still relying on simple passwords have a better shot at keeping their bank accounts secure.

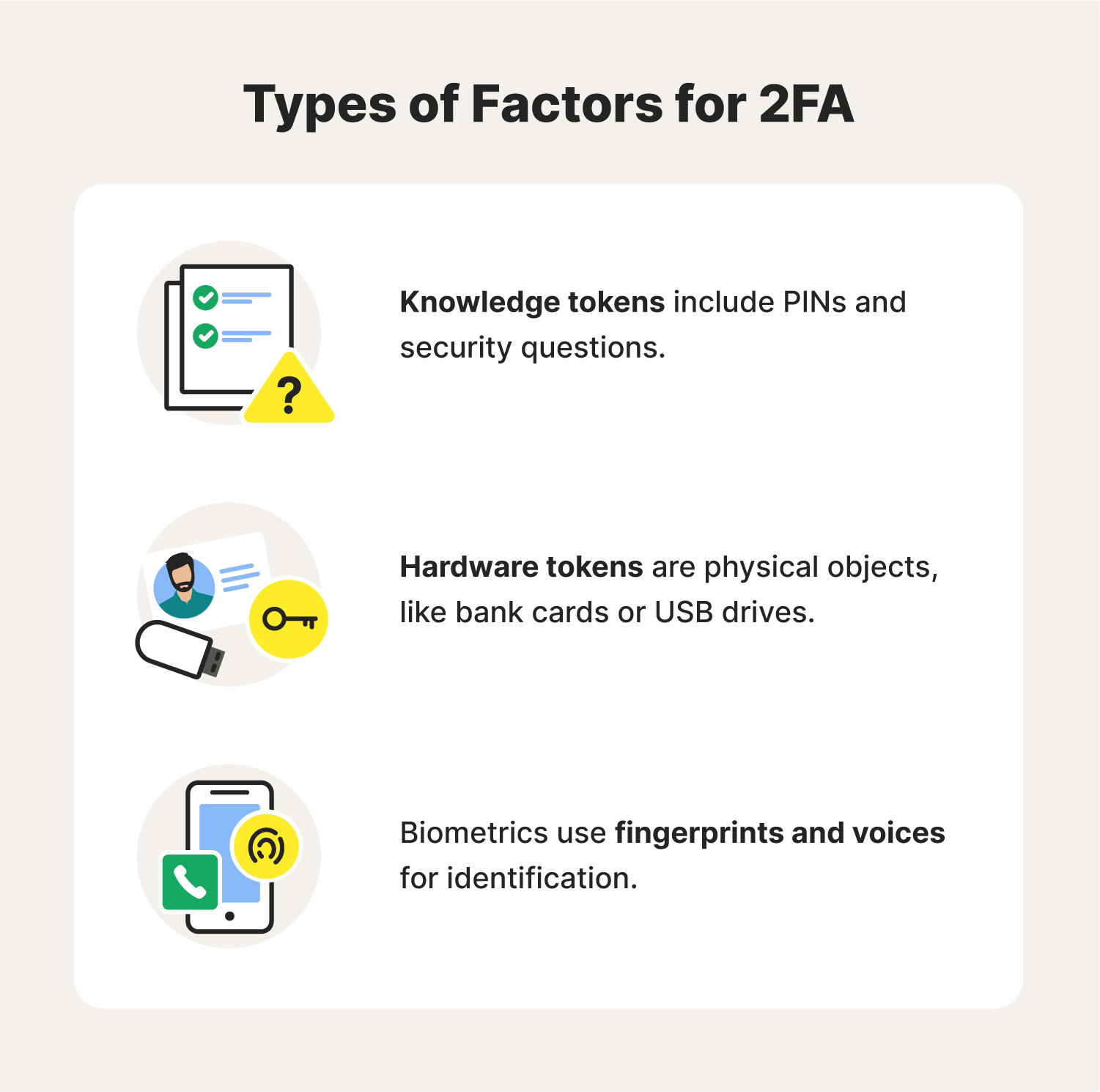

Types of 2FA security

There are several types of two-factor authentication security, including:

- Something you know: These kinds of 2FA use a code, question, or password that are unique to you. Using your PIN at an ATM is a form of 2FA that requires something you know.

- Something you have: This type of 2FA requires users to possess a type of physical token or device, such as a phone or USB token, that they need to use to log in. When you need to enter a code you receive via email or text before you can log in, or when you use an Authenticator app, you’re using this method of 2FA.

- Something you are: This type of 2FA requires biometrics like fingerprint or facial recognition or a physical location (confirmed by GPS) to confirm your identity.

Now that you know the different types of 2FA verification, let’s learn how to enable it on your devices.

How to get 2FA on your accounts

Though not all sites use 2FA, some give you the option to activate it for your account. For sites that allow you to enable 2FA, you can turn it on in your account security or privacy settings.

Some popular websites that do enable 2FA include:

- Amazon

- Facebook and Instagram

- Dropbox

- LastPass

- Intuit

- TurboTax

- Mint

- PayPal

- Yahoo

If a site or platform you use doesn’t offer 2FA yet, consider using a secure password manager to help you store and create stronger passwords.

Adding two-factor authentication to your high-priority accounts can help keep you, your money, and your personal information more secure.

Tip: If you’re using your phone as your 2FA method, make sure it’s also password-protected. Otherwise, if your phone is lost or stolen, scammers could access your accounts.

3 benefits of 2FA

The added security and protection that two-factor authentication gives you is a net positive. But there are a few extra benefits that you might not know about, including:

- Account monitoring: You’ll know if someone is trying to access your accounts because you’ll receive a message or prompt on your device. That allows you to report it and further strengthen your security by changing your password to something stronger.

- Dynamic process: 2FA authenticator apps, push notifications, and texts are generated and sent when you log in, meaning you don’t have to worry about securely storing another factor.

- Account recovery assistance: 2FA means that you don’t have to put in a help desk ticket or try to get on the phone with a support team member to reset your logins or secure your account.

Safeguard your information and identity

Now that you know how 2FA can improve the Cyber Safety of your online accounts and your personal data, enable it wherever you can. Then, install a comprehensive security software and identity theft protection tool like Cyber1guard, which helps protect against malware, encrypt your connection with a VPN, and safeguard your identity against scammers. Plus, our restoration specialists will help you restore your identity should the unthinkable happen.

cialis for bph: TadalAccess – cialis priligy online australia

cialis generic overnite shipping cialis super active plus reviews benefits of tadalafil over sidenafil

https://tadalaccess.com/# canadian pharmacy tadalafil 20mg

canadian online pharmacy no prescription cialis dapoxetine cialis pricing or online cialis no prescription

https://maps.google.ge/url?sa=t&url=https://tadalaccess.com cialis sample

cialis generic overnite cialis advertisement and cialis payment with paypal cialis advertisement